SX Business Services News

SX was fortunate to welcome Jillian as a staff accountant in December of 2023, she was quickly and deservedly promoted to the position of Property Accountant a year later. She is a graduate of Suffolk University with a Bachelor of Science in Business Administration – with an accounting major and business management minor. Her father has been a business owner for 43 years and motivated her to garner the minor in business management to someday follow in his footsteps. Growing up in West Bridgewater, MA, she claims her summers were the best part of living there and enjoyed each season at the beach tanning away. She has two older siblings, one brother and one sister whom she is very close to. Her family had a black labrador for over 13 years and they miss her dearly. Someday she wishes to be home more to have the flexibility to adopt at least one dog again. She is looking forward to the opportunity to travel and has never really left the United States. Her family went to Niagara Falls on the Canada side when she was two… that counts right!!? A short list of dream locales to visit include Italy, Greece, Dubai, Hawaii, and any other tropical islands. Jillian – ‘In her own words’: Have you learned anything new as an adult that you didn’t experience as a child? I recently tried skiing for the first time, and I absolutely loved it. I gave my retired gymnast self-credit as it was easy to learn. I enjoy being active. If you could have any other job, what would it be? My dream job would be to own a busy coffee shop or café since my two prior years working at Starbucks gained me a coffee addiction. I would also like to open a business for mind/body health – such as a trampoline park to help people suffering from fibromyalgia/ being a fitness instructor/ and potentially help people further with their health through supplementation/diet. What do you like most about your job, and/or working for SX? I enjoy accounting especially ever since I got to SX – I have noticed great vibes since coming here, and everyone is super helpful. We really make a great team.

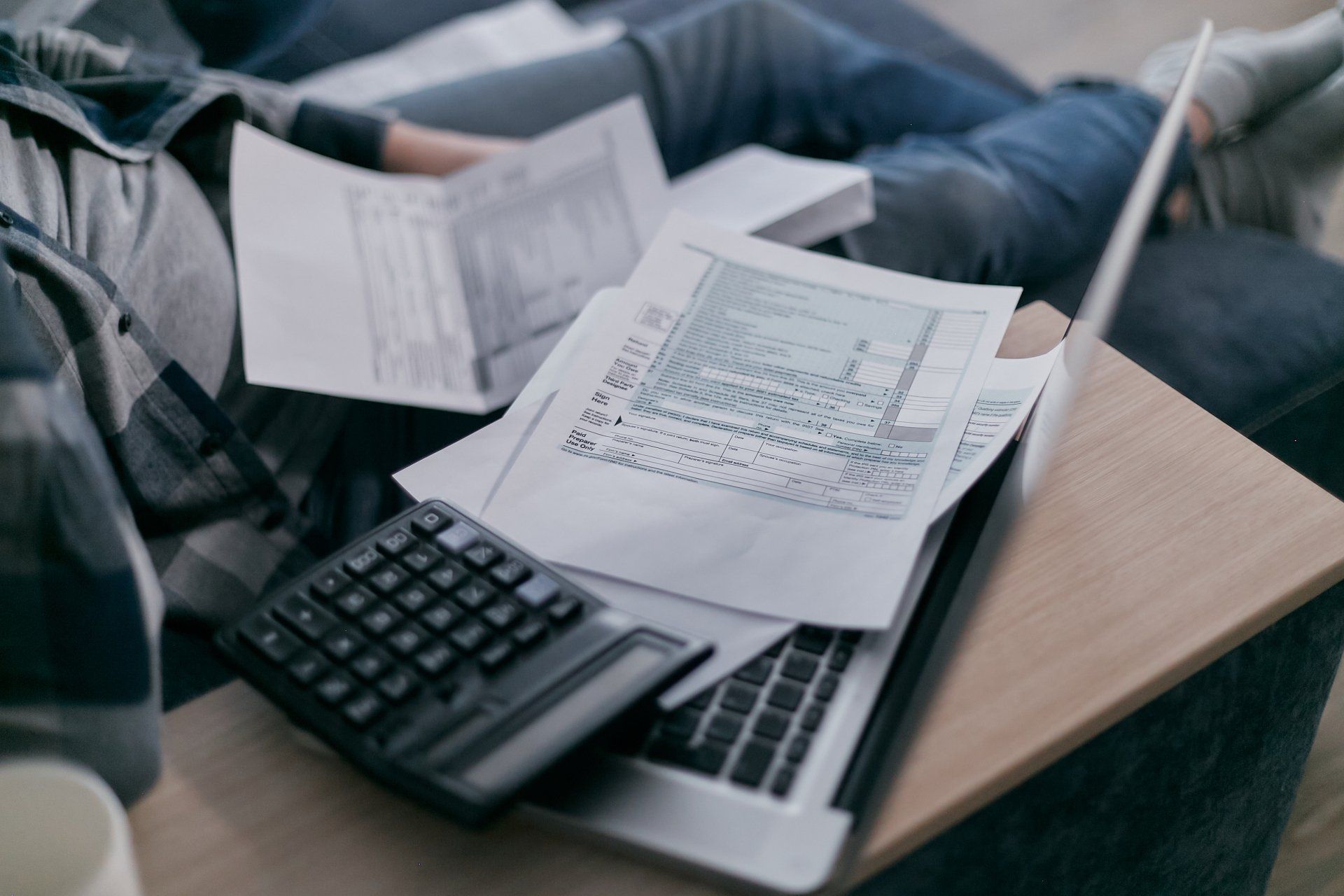

In real estate, the accounts payable (AP) department functions similarly to AP departments in other industries but with some distinct differences due to the nature of real estate transactions and operations. Here are a few ways in which an accounts payable department in real estate might differ: Volume and Complexity of Invoices: Real estate companies often deal with a high volume of invoices from various vendors, including contractors, suppliers, utility companies, property management firms, and more. These invoices can vary significantly in terms of complexity, such as invoices for property maintenance, repairs, renovations, leasing expenses, property taxes, and utility bills. As such, the AP department in real estate needs to efficiently process a diverse range of invoices while ensuring accuracy and compliance. Property-specific Expenses: Real estate companies typically manage multiple properties, each with its own set of expenses. The AP department must track and manage property-specific expenses, such as maintenance and repair costs, property taxes, insurance premiums, and utilities. This requires robust accounting systems and processes to allocate expenses accurately to the appropriate properties and projects. Vendor Relationships: Building and maintaining strong relationships with vendors are crucial in real estate. The AP department may work closely with vendors to negotiate payment terms, resolve billing discrepancies, and ensure timely payments. Additionally, real estate companies often rely on long-term relationships with contractors, suppliers, and service providers, so the AP department plays a key role in fostering these relationships to ensure smooth operations. Compliance and Regulations: Real estate transactions and operations are subject to various regulatory requirements and compliance standards, which can vary by jurisdiction. The AP department must stay updated on relevant regulations related to taxation, leasing, property management, and other aspects of real estate finance. Compliance with regulations such as lease accounting standards (e.g., ASC 842) and tax laws is essential to avoid penalties and ensure accurate financial reporting. Budgeting and Forecasting: Real estate companies typically have extensive budgets and financial forecasts that the AP department contributes to by providing data on expenses and payables. This may involve analyzing historical spending patterns, projecting future expenses, and collaborating with other departments, such as finance and asset management, to develop accurate budgets and forecasts. Overall, while the core functions of an accounts payable department remain consistent across industries, the unique characteristics of the real estate sector necessitate specific skills, processes, and expertise to effectively manage payables and support the financial health of the organization. If you have any questions about how SX Business Services can assist you with your outsourced accounts payable needs, please reach out today!

Introduction In today's fast-paced business environment, companies are constantly seeking ways to enhance operational efficiency, cut costs, and improve their bottom line. A strategic approach that has gained traction is the outsourcing of accounts payable (AP) services. Outsourcing AP functions involves delegating responsibilities related to invoice management, vendor payments, and associated tasks to external service providers. This article delves into the advantages that businesses can leverage by adopting outsourced accounts payable services. Economical Advantage Opting for outsourced accounts payable services can significantly affect a company's financial standing. Running an in-house AP department demands substantial investment in terms of personnel, technology, infrastructure, and ongoing training. By outsourcing, organizations can offload these expenses to specialized providers who can capitalize on economies of scale. This often translates to reduced overheads and labor costs, allowing companies to redistribute resources more strategically. Heightened Precision The accuracy of the accounts payable process is of paramount importance. Errors can lead to late payments, strained vendor relationships, and even regulatory non-compliance. Outsourced AP services typically incorporate cutting-edge technologies and skilled professionals who are well-versed in handling invoices and payments with precision. Automated tools like optical character recognition (OCR) and machine learning contribute to the meticulous processing of invoice data, moderating the risk of human mistakes and ensuring unimpeachable record-keeping. Enhanced Efficiency Outsourced accounts payable services are designed to optimize the entire AP cycle. They often employ streamlined workflows, digital document management systems, and automated approval procedures. These advancements expedite invoice processing, minimize bottlenecks, and overall enhance the efficiency of the accounts payable process. Quicker processing translates to prompt vendor payments, fostering healthier vendor relationships and potential discounts for timely settlements. Access to Expertise The world of accounts payable is subject to dynamic regulatory changes, tax codes, and compliance standards. Managing these complexities can be intricate for companies without dedicated expertise. Outsourced AP service providers specialize in industry best practices and stay abreast of regulatory shifts. By collaborating with these experts, organizations can ensure their AP processes remain compliant, thereby mitigating the risk of penalties and legal entanglements. Focus on Core Competencies Outsourcing non-core functions, like accounts payable, enables enterprises to concentrate on their core business activities. By entrusting routine AP tasks to external professionals, internal teams can channel their time and efforts into strategic initiatives that drive growth, innovation, and competitive edge. This change in focus often translates into improved overall performance and increased stakeholder value. Scalability and Flexibility Companies often experience fluctuations in their AP workload due to seasonal patterns, expansion, or market dynamics. Outsourced accounts payable services offer the flexibility to adjust operations based on these instabilities without the need to hire or reduce staff. This adaptability ensures that AP processes remain streamlined regardless of the company's size or circumstances. Conclusion The utilization of outsourced accounts payable services, such as SX Business Services, stands as a strategic choice for businesses looking to optimize their financial processes. From financial savings and heightened precision to improved efficiency and access to specialized knowledge, the benefits of outsourcing AP functions are diverse. By entrusting our expert staff with the management of invoices, vendor payments, and compliance requirements, companies can achieve superior operational efficiency, enabling them to focus on their core strengths and strategic advancement.

She was born in Savannah, Georgia and moved to Easton at 4 years old. According to her uncles she grew up a Yankee. She met her husband in high school, but they didn’t begin dating until they were 20 and now have been married for 32 years! They raised a beautiful family with 4 daughters in Foxboro, MA. They currently have three grandchildren. Deb played soccer at North Adams State (now called Massachusetts College of Liberal Arts) where she received her business degree. She passed along her athleticism to her offspring. All four of her daughters played college sports: Cory competed in Gymnastics @ RIC, Kayla played Soccer and Lacrosse at Fitchburg State, Emma was on the Swim Team at UMBC, Annika was on the Diving Team at UMBC. For fun, she likes to hike, kayak and ski. There are 11 years between her eldest and youngest children. The vacations that made all ages happy were trips to the beach, Disney, and skiing. Her past jobs have always been in finance. She previously worked for a financial planner, an events company and an apartment management company. The similarities between her previous jobs and her responsibilities at SX made for an easy transition. What has been your experience so far at SX Business? On my very first day here at SX people made me feel welcome. SX is a very friendly environment, people work well together, everyone is approachable and willing to help where needed.

Liz joined SX in March of 2022 as a Real Estate Staff accountant. Shortly after she graduated with a Master’s in Accounting from Suffolk University in May of 2022. The youngest of three, she grew up with her older brother and sister in a suburb of Kansas City on the Kansas side. She attended boarding schools in Georgia and Vermont but after graduation from school she decided she wanted to live closer to Boston. There she attended Endicott College and graduated in 2005 with a Bachelor’s in Psychology and a Minor in Literature. Her first job was working at a residential home for at risk adolescents where she became a Shift Supervisor. Her next job was working as a protective service worker for the elderly community of Massachusetts. In that role, she investigated allegations of abuse. After years of working in this capacity, she became interested in owning her own business and decided to study Accounting. This avenue of study helped Liz to see the world with a whole new understanding. In her downtime, you will often find her out and about, where she likes to strike up conversations with anyone who will talk to her. She is an altruistic person and is known to make friends anywhere she goes. Liz enjoys talking and listening to people as it helps her to see the world through a different perspective. She believes that everyone has something to learn (and teach) from everyone they meet. Liz is also an avid reader and like books that help to expand her mindset. Once she finds a topic, she is interested in learning about she will find and read any book that might help her to better understand that subject. What do you like most about your job? I feel extremely fortunate to be working at SX, as the environment allows me to grow and improve on a daily basis. The atmosphere at SX is the best. I feel very supported and feel like I can ask any question and any of my coworkers will be willing to help me. I’ve been interested in real estate for many years and am happy that I get to do accounting that helps me to understand this topic even more. What is your dream job? I would love to be able to combine my experience in human services, my natural ability to talk and work with people, and my knowledge of accounting to become someone who helps others make better financial decisions. I would also like to become an author at some point.