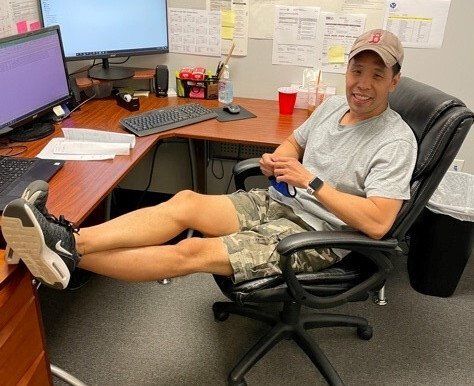

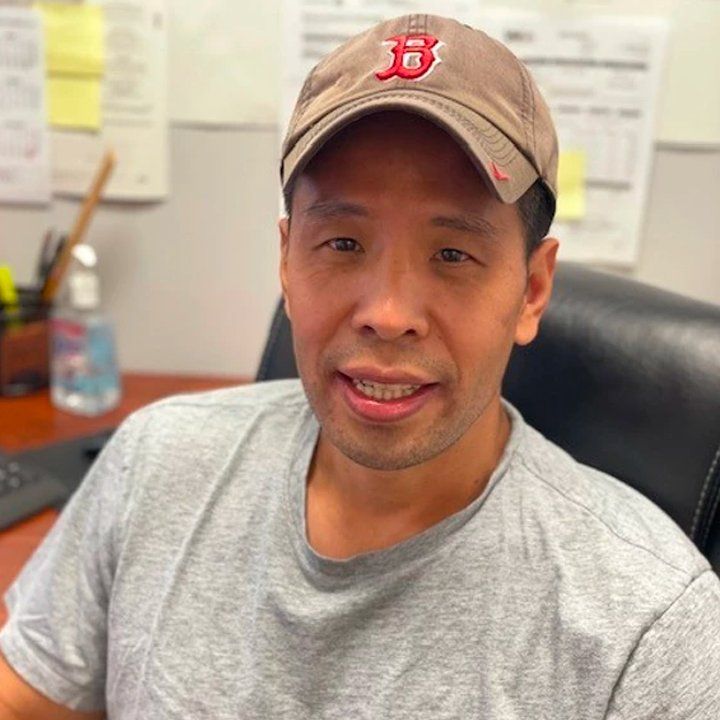

In March 2019, Jack joined SX Business Services working in our Accounts Payable department. Prior to working at SX, he held positions as an Accounting Associate at Northland Investments, as an Accounts Payable Specialist at Shriner’s Hospital and a Corporate Accountant at Colliers in Boston. In addition to his traditional work duties Jack, has adopted the role of activities coordinator. He runs the office-wide football pool each season and organizes social activities outside the office, including our Thirsty Thursdays, so employees can catch-up after work.

Jack is ABC (American Born Chinese). He is fluent in Cantonese and knowledgeable in Spanish. He has two siblings, an identical twin brother and an older sister. He attended Randolph High School and graduated from the University of Massachusetts Amherst in 2001 with Bachelors Arts & Science. He is a huge Patriots fan, and enjoys watching football when he has the time

He likes to travel 3-4 times a year to different destinations. He is a big foodie and is a connoisseur of wine, craft beers and whiskey. When he travels to new places, he uses Yelp to identify the best places to eat. In addition to travelling, Jack enjoys hiking, taking walks, biking, going to the gym and all outdoor activities.

What do you like most about your job?

I like that I am able to work with several clients and use multiple software platforms. My job is close commute from my home and I don’t have to travel to Boston. Everyone here at SX Business is friendly and team-oriented.

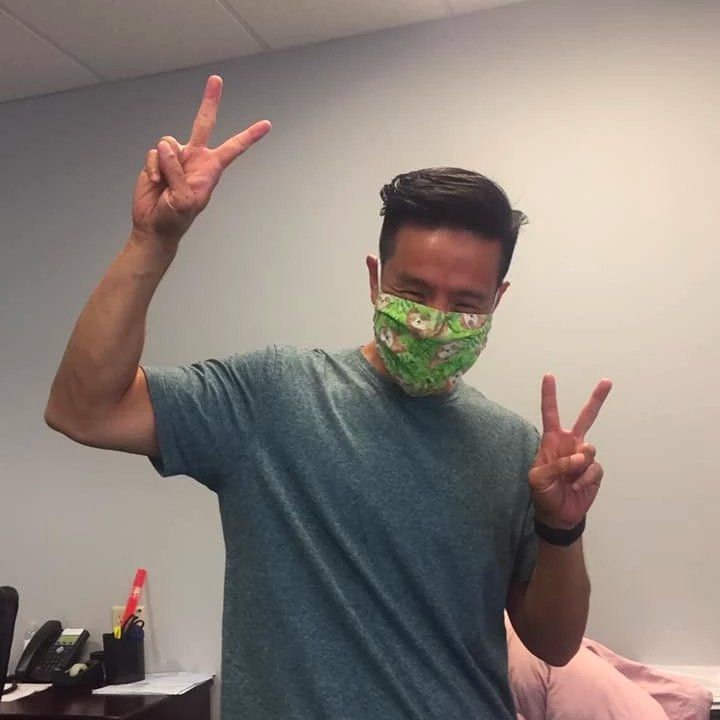

What is your dream job?

If I could have my dream job, I think I would like to be a food critic. I want to be the next Anthony Bourdain. I enjoy eating good food and traveling. I would love to travel to other countries and try all types of food.